The past three years have been outstanding for investors who put their money into semiconductor stocks, as shown by the PHLX Semiconductor Sector index, which clocked outstanding returns of 83% during these 36 months, far outperforming the Nasdaq-100 Technology Sector index’s nearly 32% gains.

However, not all semiconductor stocks benefited from the broader index’s surge. Intel (INTC -1.13%) stock, for instance, lost 45% of its value in the past three years. Let’s see why that has been the case and check if its fortunes could improve over the next three years.

Market share losses have weighed Intel down

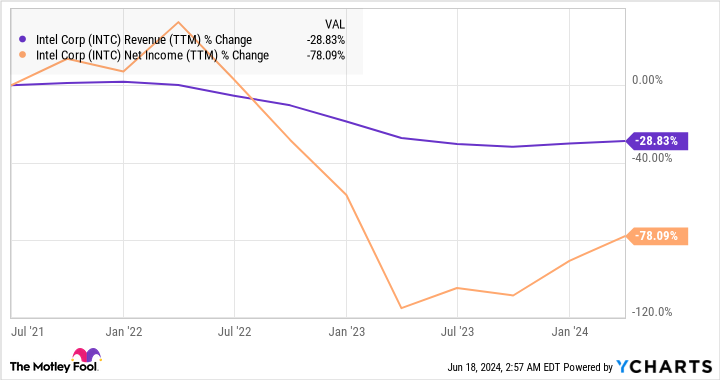

Intel’s revenue and earnings declined over the past three years as the company lost share in the personal computer (PC) and server markets to rival Advanced Micro Devices (AMD -2.38%).

INTC revenue (TTM) data by YCharts; TTM = trailing 12 months.

At the end of 2020, AMD controlled just under 22% of the x86 processor market (including both PC and server processors). More specifically, AMD’s market share in server central processing units (CPU) stood at 7.1% in the fourth quarter of 2020, while its share of desktop and notebook CPUs was at 19%. Intel controlled the rest of the market.

Cut to the first quarter of 2024, AMD’s unit share of server CPUs increased to 23.6%, while its revenue share was 33%. Its shares of desktop and mobile CPUs were 24% and 19.3%, respectively.

So AMD has been eating Intel’s lunch, and that translated into solid revenue gains for the chipmaker in the past three years.

AMD revenue (TTM) data by YCharts.

It’s easy to see why Intel stock underperformed during this period. The company’s decline in the PC market over the past couple of years has weakened investor confidence. But will Intel be able to regain its mojo and do better over the next three years thanks to the emergence of new catalysts such as artificial intelligence (AI)?

Can investors expect a turnaround?

Intel’s first-quarter 2024 results point toward an improvement in the company’s fortunes. Quarterly revenue increased 9% year over year to $12.7 billion following a 14% decline in its top line last year to $54.2 billion. The company also posted an adjusted profit of $0.18 per share as compared to an adjusted loss of $0.04 per share in the year-ago period.

Intel’s first-quarter growth was driven by a 31% year-over-year increase in revenue from its client computing group (CCG) — which includes sales of PC CPUs — to $7.5 billion. It also posted a 5% increase in revenue in its data center and AI segment. The good part is that the adoption of AI has opened a secular growth opportunity with the demand for AI-enabled PCs and server processors set to increase in the long run.

For instance, Canalys estimates that AI-enabled PCs will account for 60% of overall PC shipments by 2027 as compared to 19% this year. Intel is capitalizing on this market with its Core Ultra processors, which it claims are capable of running more than 500 AI models locally on PCs.

It is worth noting that Core Ultra processors were inside more than 5 million AI-enabled PCs shipped in the first quarter of 2024. The company expects to ship over 40 million of these PCs by the end of the year. So there is a good chance that Intel’s CCG business could keep improving in 2024 and beyond as AI PC shipments gain momentum.

Meanwhile, the company is trying to enter the market for AI data center accelerators as well. It recently unveiled its Gaudi 3 accelerator, which it claims can compete with industry leader Nvidia‘s popular H100 AI graphics card when it comes to performing inference on leading generative AI models. Intel says that it has brought in new customers and partners who are going to deploy its new AI chip. More importantly, it is looking to push the envelope by securing all five units of ASML‘s advanced high-NA extreme ultraviolet (EUV) lithography chipmaking equipment for 2024.

ASML can manufacture only five to six units of these machines each year, which means that Intel’s rivals will have to wait until the second half of next year to get their hands on them. As a result, Intel might be able to reduce the technology gap with rival foundries, such as Taiwan Semiconductor Manufacturing, since it should ideally be able to manufacture chips on smaller process nodes with ASML’s new machines.

Given these potential growth catalysts, it is not surprising that analysts expect Intel’s revenue growth to improve starting next year.

INTC revenue estimates for current fiscal year; data by YCharts.

Intel currently trades at 2.3 times sales, a big discount to the U.S. tech sector’s average sales multiple of 8. If the company’s growth accelerates thanks to the above-mentioned catalysts and its top line indeed nears $70 billion within the next three years, the market could reward it with a higher sales multiple.

That could translate into better stock performance over the next three years, which is why investors looking to add a semiconductor stock to their portfolios would do well to keep Intel on their radar and consider buying it if there are consistent signs of a turnaround in the coming quarters.